utah tax commission power of attorney

The Tax Commission Appeals Unit will accept all written submissions and forms by facsimile e-mail or. Ad No Money To Pay IRS Back Tax.

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Contact us whenever you need it.

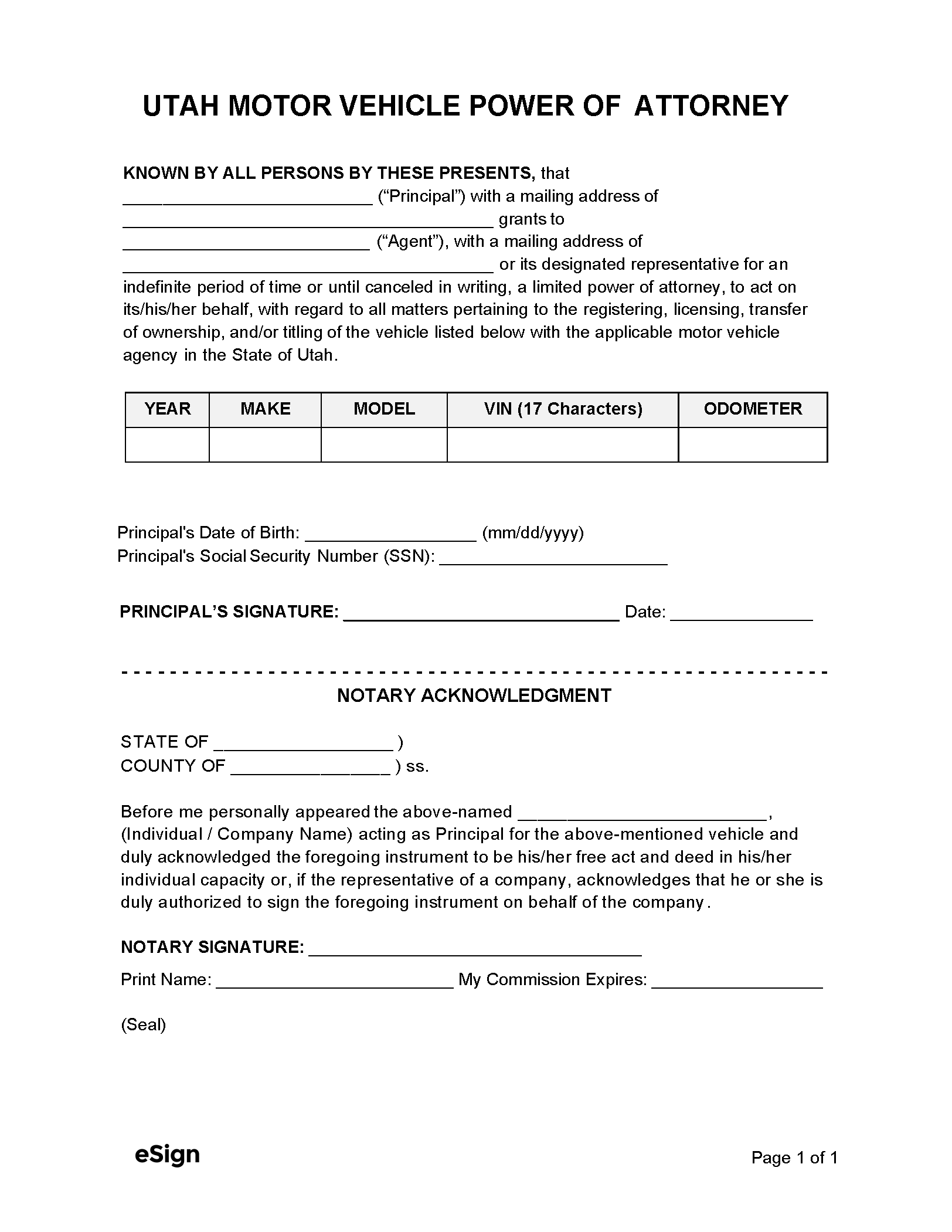

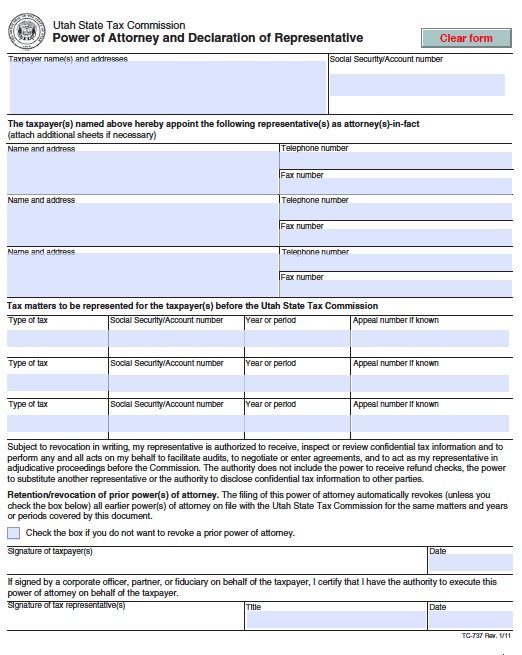

. Utah power of attorney forms allow for representation granted by a resident for any financial medical tax filing and parental guardianship minor child decisions on their behalf. The Utah tax power of attorney form otherwise known as form TC-737 allows for the appointment of a tax representative to handle any and all State tax filings with the Utah State. 801-297-3573 Power of Attorney and Declaration.

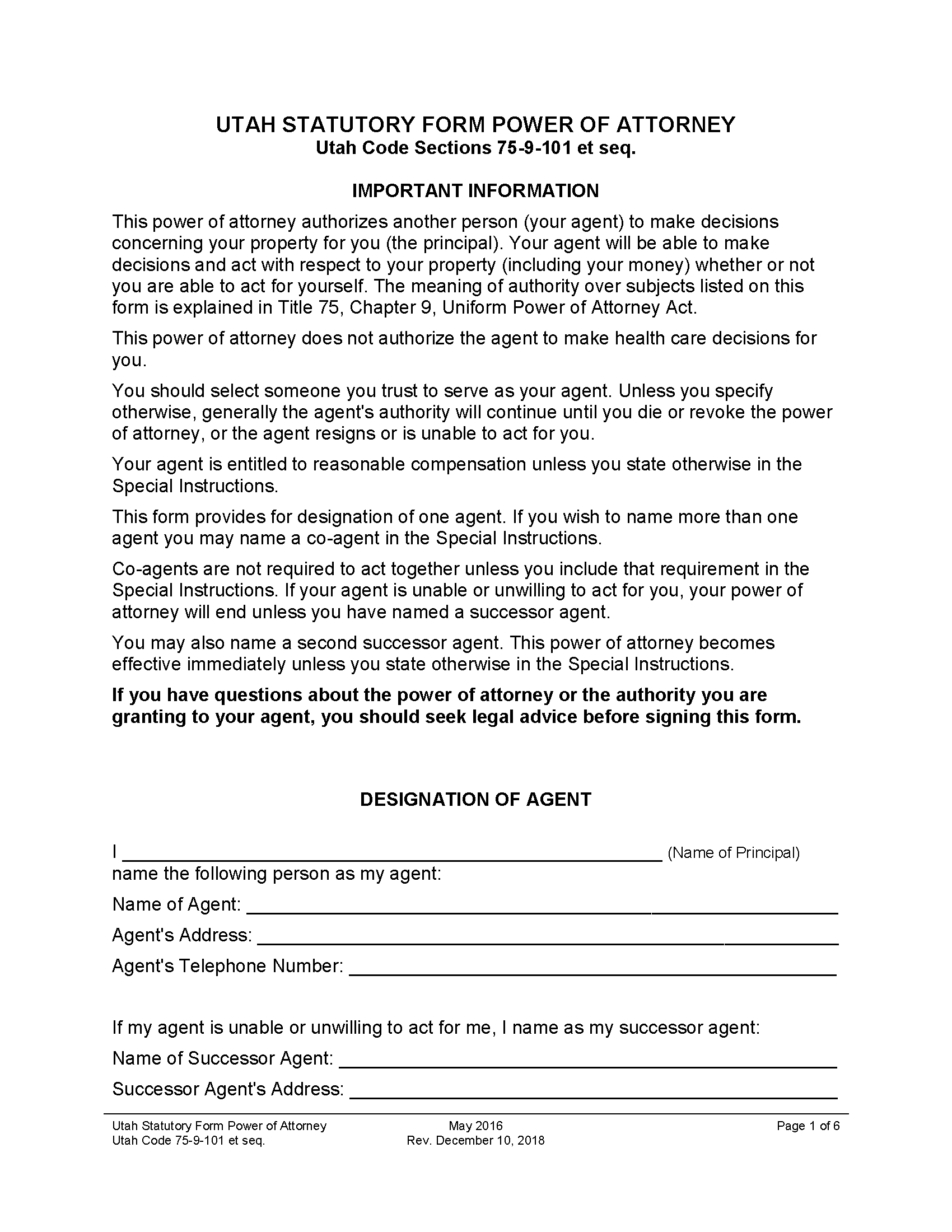

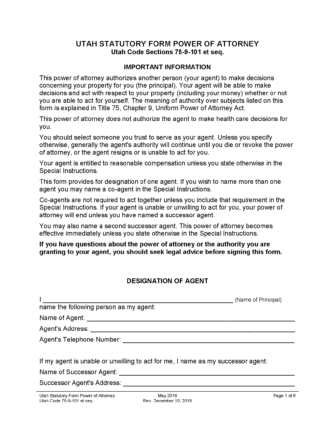

The Leading Online Publisher of National and State-specific Power of Attorney Legal Docs. Start a Utah Power of Attorney form tailored to your exact needs with the help of step-by-step guidance and expert templates. TC-737 Power of Attorney and Declaration of Representative.

The form can be used by any adult who has the capacity to. Report a Power Outage or Water Issue The mission statement for the City of St. Ad No Money To Pay IRS Back Tax.

The Leading Online Publisher of National and State-specific Power of Attorney Legal Docs. Ad Instant Download and Complete your Power of Attorney Forms Start Now. If signed by a corporate officer partner or fiduciary on behalf of the taxpayer I certify that I have the authority to execute this power-of-attorney on behalf of the taxpayer.

A power of attorney POA is a legal document in which one person called the principal gives to another person the agent or sometimes called the attorney in fact authority to act on. Utah Tax Power Of Attorney Form - ID5dec0514ada6e. Utah law provides a statutory power of attorney form the Uniform Power of Attorney Act Utah Code 75-9-101 to 403.

File electronically using Taxpayer Access Point at. Utah State Tax Commission 210 N 1950 W SLC UT 84134 taxutahgov 801-297-2200 fax. Utah State Tax Commission 210 N 1950 W SLC UT 84134 taxutahgov 801-297-2200 fax.

Use TC-737 for other tax types. Otherwise known as form TC-737 the document allows for the appointment of a tax representative to handle any and all State tax filings with the Utah State Tax Commission. How do I get a power of attorney in Utah.

The TFS Division represents the divisions of the Utah State Tax Commission in administrative proceedings heard by the Tax Commission and represents the Tax Commission. Account Information provide information for only one. Utah State Tax Commission 210 N 1950 W SLC UT 84134 taxutahgov 801-297-2200 fax.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. The Power of Attorney Form will also need to be to be signed by a notary public and have a notary seal at the bottom of the second page before being returned to OnPay. Taxpayer Access Point TAP.

Ad Instant Download and Complete your Power of Attorney Forms Start Now. This Power of Attorney and Declaration of Representative will remain in effect until revoked.

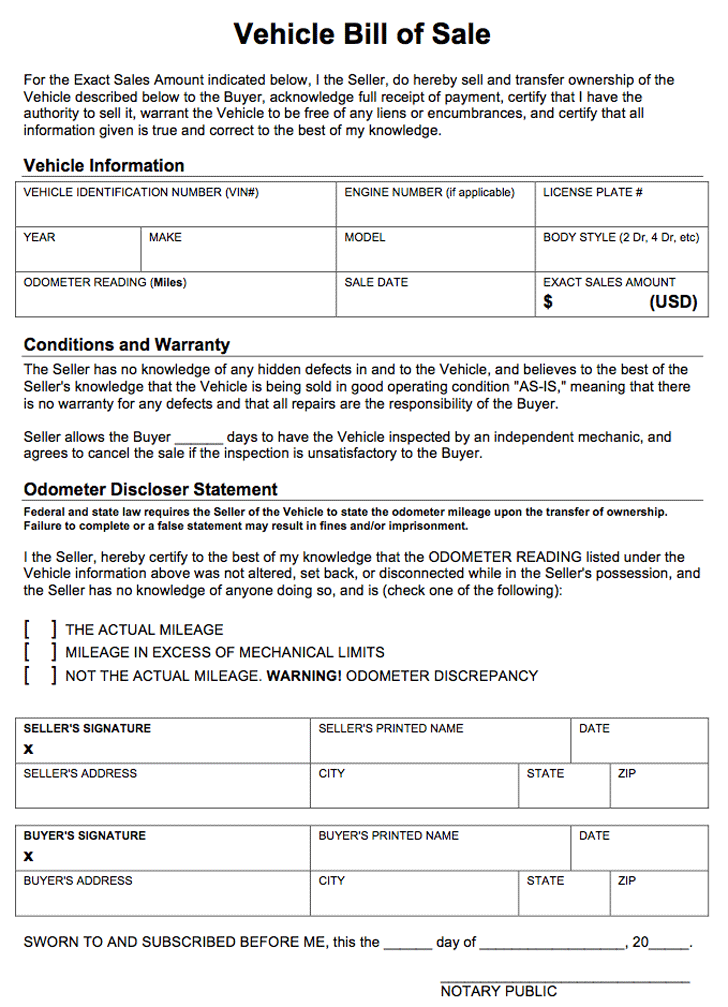

Free Bill Of Sale Utah State Tax Commission Doc 38kb 1 Page S

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Western Heritage Festival Payson Utah

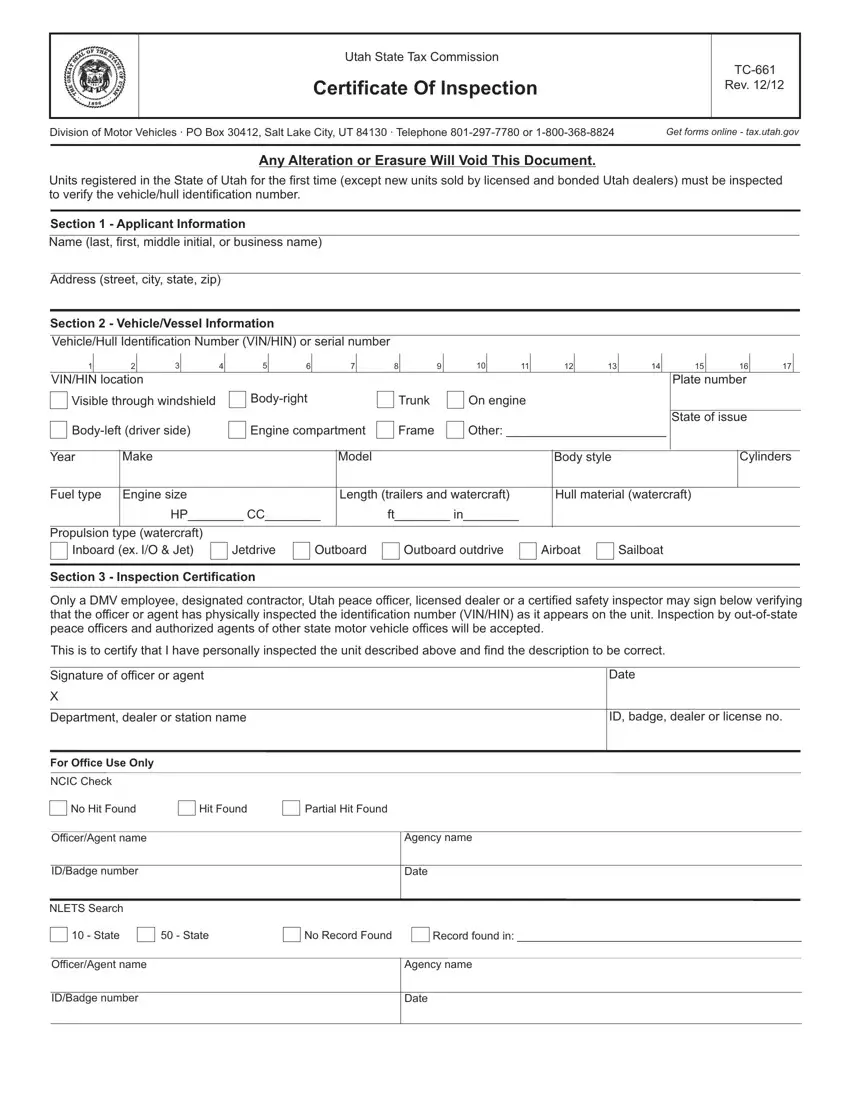

Utah Tc 661 Form Fill Out Printable Pdf Forms Online

Free Utah Power Of Attorney Forms Pdf Word

Free Utah Tax Power Of Attorney Form Pdf

Free Utah Power Of Attorney Forms Pdf Word

Limited Power Of Attorney Definition Free Printable Form Formswift

Free Utah Power Of Attorney Forms Pdf Word

Free Tax Power Of Attorney Utah Form Pdf

Utah Back Taxes Resolution Guide Resolving Ut Tax Problems

Free Durable Power Of Attorney Free To Print Save Download

Utah Vehicle Registration And Renewal Vincheck Info

Free Utah Tax Power Of Attorney Form Tc 737 Pdf Eforms

Utah Lawmakers Punish Intermountain Power Allege The Utility S Interests No Longer Align With The State